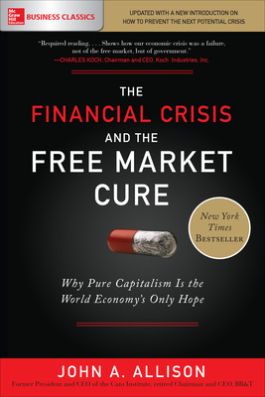

The Financial Crisis and the Free Market Cure: Why Pure Capitalism is the World Economy's Only Hope

1st Edition

1260143457

·

9781260143454

© 2018 | Published: May 7, 2018

WHAT HAVE WE LEARNED FROM THE FINANCIAL CRISIS?NOTHING.The informative bestseller that shows us where our economy went wrong—and what we can do about it—with a timely new introduction.One of the most important books to emerge from the 2008 econom…

Read More

Request Review Copy

Receive via shipping:

- Print bound version of the complete text

Introduction to the Paperback Edition

Introduction

1: Fundamental Themes

2: What Happened?

3: Government Monetary Policy: The Fed as the Primary Cause

4: FDIC Insurance: The Background Cause

5: Government Housing Policy: The Proximate Cause

6: The Essential Role of Banks in a Complex Economy: The Liquidity Challenge

7: The Residential Real-Estate-Market Bubble and Financial-Market Stress

8: Failure of the Rating Agencies: The Subprime Mortgage Market and Its Impact on Capital Markets

9: Pick-a-Payment Mortgages: A Toxic Product of FDIC Insurance Coverage

10: How Freddie and Fannie Grew to Dominate the Home Mortgage Lending Business

11: Fair-Value Accounting and Wealth Destruction

12: Derivatives and Shadow Banking: A Misunderstanding

13: The Myth that "Deregulation" Caused the Financial Crisis

14: How the SEC Made Matters Worse

15: Market Corrections Are Necessary, but Panics Are Destructive and Avoidable

16: TARP (Troubled Asset Relief Program)

17: What We Could Have--and Should Have--Done

18: The Cure for the Banking Industry: Systematically Move Toward Pure Capitalism

19: Some Political Cures: Government Policy

20: Our Short-Term Path and How to End Unemployment

21: The Deepest Cause Is Philosophical

22: The Cure Is Also Philosophical

23: How the United States Could Go Broke

24: The Need for Principled Action

25: Conclusion

Notes

Index

Acknowledgments

Introduction

1: Fundamental Themes

2: What Happened?

3: Government Monetary Policy: The Fed as the Primary Cause

4: FDIC Insurance: The Background Cause

5: Government Housing Policy: The Proximate Cause

6: The Essential Role of Banks in a Complex Economy: The Liquidity Challenge

7: The Residential Real-Estate-Market Bubble and Financial-Market Stress

8: Failure of the Rating Agencies: The Subprime Mortgage Market and Its Impact on Capital Markets

9: Pick-a-Payment Mortgages: A Toxic Product of FDIC Insurance Coverage

10: How Freddie and Fannie Grew to Dominate the Home Mortgage Lending Business

11: Fair-Value Accounting and Wealth Destruction

12: Derivatives and Shadow Banking: A Misunderstanding

13: The Myth that "Deregulation" Caused the Financial Crisis

14: How the SEC Made Matters Worse

15: Market Corrections Are Necessary, but Panics Are Destructive and Avoidable

16: TARP (Troubled Asset Relief Program)

17: What We Could Have--and Should Have--Done

18: The Cure for the Banking Industry: Systematically Move Toward Pure Capitalism

19: Some Political Cures: Government Policy

20: Our Short-Term Path and How to End Unemployment

21: The Deepest Cause Is Philosophical

22: The Cure Is Also Philosophical

23: How the United States Could Go Broke

24: The Need for Principled Action

25: Conclusion

Notes

Index

Acknowledgments

WHAT HAVE WE LEARNED FROM THE FINANCIAL CRISIS?NOTHING.

The informative bestseller that shows us where our economy went wrong—and what we can do about it—with a timely new introduction.

One of the most important books to emerge from the 2008 economic crisis, this powerful wake-up call from financial expert John Allison has become a classic in the field. Now, in light of emerging global trends and shakeups in the stock market, the book’s message is more timely than ever: The government should stop trying to fix our economy. The free market is our best and only hope. In this eye-opening book, Allison reveals:

• How the Federal Reserve has even more power than before the Great Recession—and why this is a problem.

• How Wall Street has been wrongly blamed for our slow economic recovery—and why it’s Washington’s fault.

• How government regulations like Dodd Frank have burdened banks—and stifled growth.

• How socialized medicine and entitlements drive up costs—and how government policies exacerbate unemployment and income inequality.

• Why free market capitalism offers a proven cure for our economy—and how to make it work for all Americans.

The informative bestseller that shows us where our economy went wrong—and what we can do about it—with a timely new introduction.

One of the most important books to emerge from the 2008 economic crisis, this powerful wake-up call from financial expert John Allison has become a classic in the field. Now, in light of emerging global trends and shakeups in the stock market, the book’s message is more timely than ever: The government should stop trying to fix our economy. The free market is our best and only hope. In this eye-opening book, Allison reveals:

• How the Federal Reserve has even more power than before the Great Recession—and why this is a problem.

• How Wall Street has been wrongly blamed for our slow economic recovery—and why it’s Washington’s fault.

• How government regulations like Dodd Frank have burdened banks—and stifled growth.

• How socialized medicine and entitlements drive up costs—and how government policies exacerbate unemployment and income inequality.

• Why free market capitalism offers a proven cure for our economy—and how to make it work for all Americans.